Legacy Giving

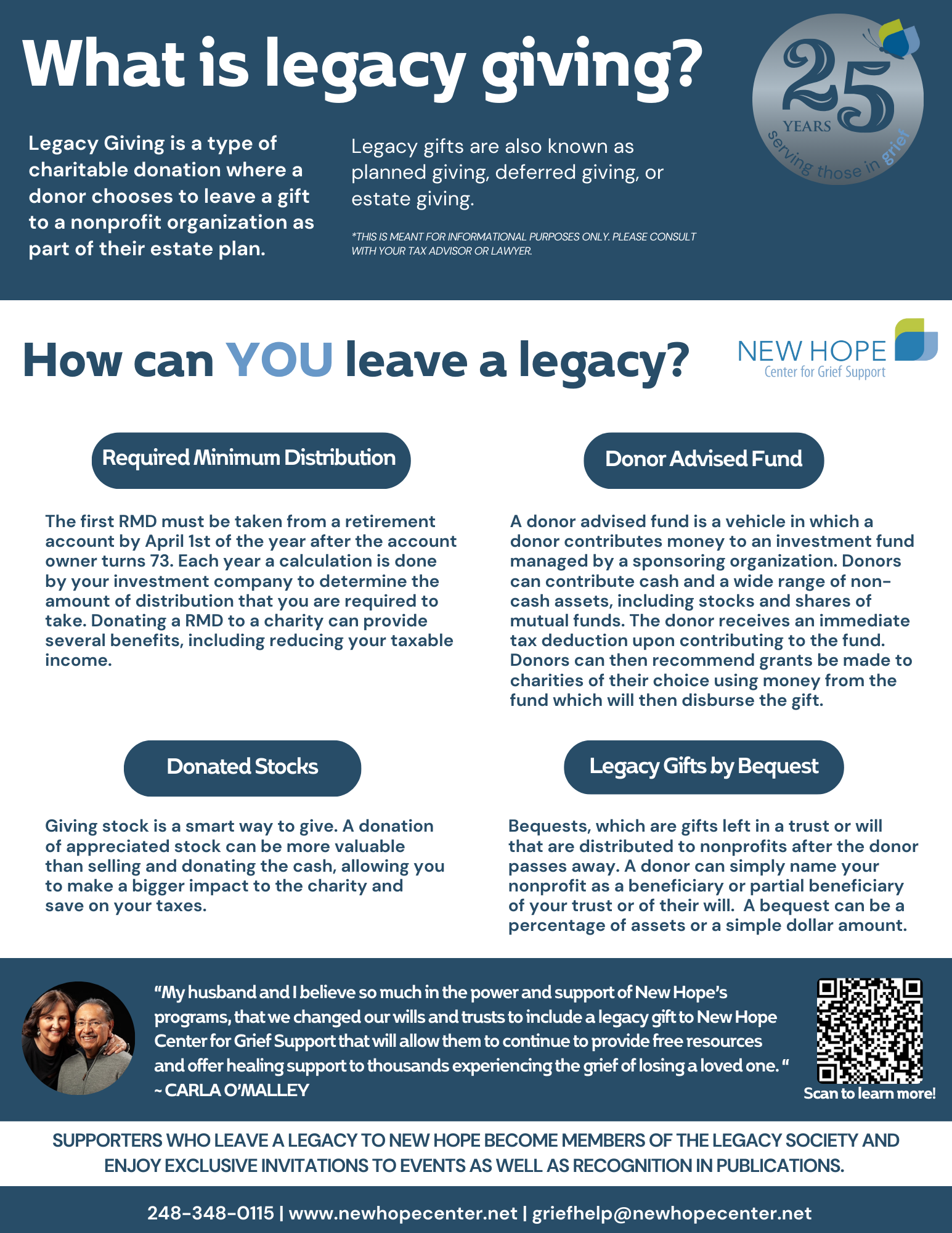

Legacy giving is a type of charitable donation where a donor chooses to leave a gift to a nonprofit organization as part of their estate plan. Legacy gifts are also known as planned giving, deferred giving, or estate giving. There are several different ways to make a Legacy Gift to New Hope Center for Grief Support.

REQUIRED MINIMUM DISTRIBUTION (RMD)

The first required minimum distribution (RMD) must be taken from a retirement account by April 2 of the year after the account owned turns 73. Each year, a calculation is done by your investment company to determine the amount of distribution that you are required to take. Donating a RMD to charity can provide several benefits, including reducing your taxable income.

DONOR ADVISED FUND (DAF)

A donor-advised fund (DAF) is a vehicle in which a donor contributes money to an investment fund managed by a sponsoring organization. Donors can contribute cash and a wide range of non-cash assets, including stocks and shares of mutual funds. The donor receives an immediate tax deduction upon contributing to the fund. Donors can then recommend donations be made to charities of their choice using money from the DAF fund which will then disburse the gift.

DONATED STOCKS

Gifting stock is a smart way to give. A donation of appreciated stock can be more valuable than selling and donating the cash, allowing you to make a bigger impact to the charity and save on your taxes.

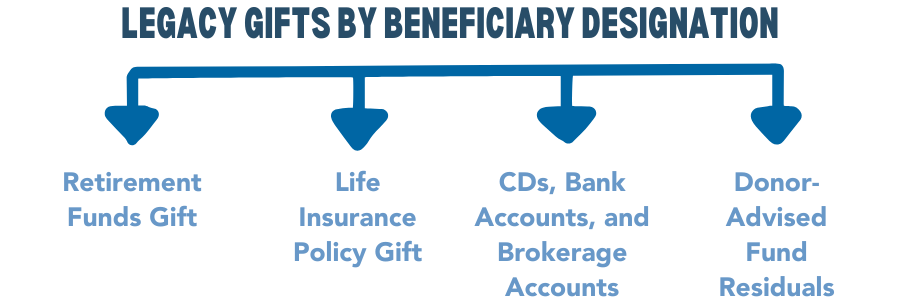

LEGACY GIFTS BY BENEFICIARY DESIGNATION

There are several types of accounts you may own where you can designate a charity as a beneficiary or a partial beneficiary of the account. After the account holder passes away, the funds will go to that charity as a legacy gift.

Retirement Funds Gift

Many people choose to name a charity as a beneficiary or a partial beneficiary of a retirement plan (IRA, 401K, or 403B Plan) to reduce their taxable estate.

Life Insurance Policy Gift

If you have a life insurance policy, a charity can be named as the beneficiary or a partial beneficiary of the policy upon the passing of the account holder.

CDs, Bank Accounts, and Brokerage Accounts

Naming a charity as the beneficiary of a certificate of deposit (CD), a check or savings bank account, or a brokerage account is one of the easiest ways to give a legacy gift to a charity.

Donor-Advised Fund Residuals

Final distribution of contributions remaining in a donor-advised fund (DAF) is governed by the contract you completed when you created your fund. A charity can be named as a successor to your account or a portion of your account value.

LEGACY GIFTS BY BEQUEST

Bequests are gifts left in a trust of will that are distributed to nonprofits after the donor passed away. A donor can simply name your nonprofit as a beneficiary or a partial beneficiary of your trust or of their will. A bequest can be a percentage of assets or a simple dollar amount.

OTHER

Please consult your tax advisor and/or attorney or other Legacy Giving strategies that may help New Hope Center for Grief Support in their mission.

If you are interested in Legacy Giving, please reach out to our team at griefhelp@newhopecenter.net for additional information.

This is meant for general informational purposes only, please consult with your tax advisor and/or attorney to determine which planned gift strategy is best for you.